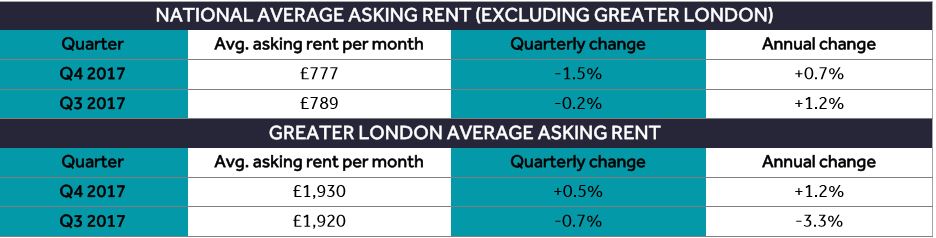

Rightmove's rental trends tracker at January 2018 has just been published, and indicates that the pace of annual rent rises s now lowest since 2014. Here are the headlines:

- 0.7% annual rate of increase in national asking rents (excluding London) in 2017, the lowest since 2014

- Asking rents in London ended the year 1.2% higher than at the end of 2016, the first time the annual rate in the capital has been in positive territory in nearly two years

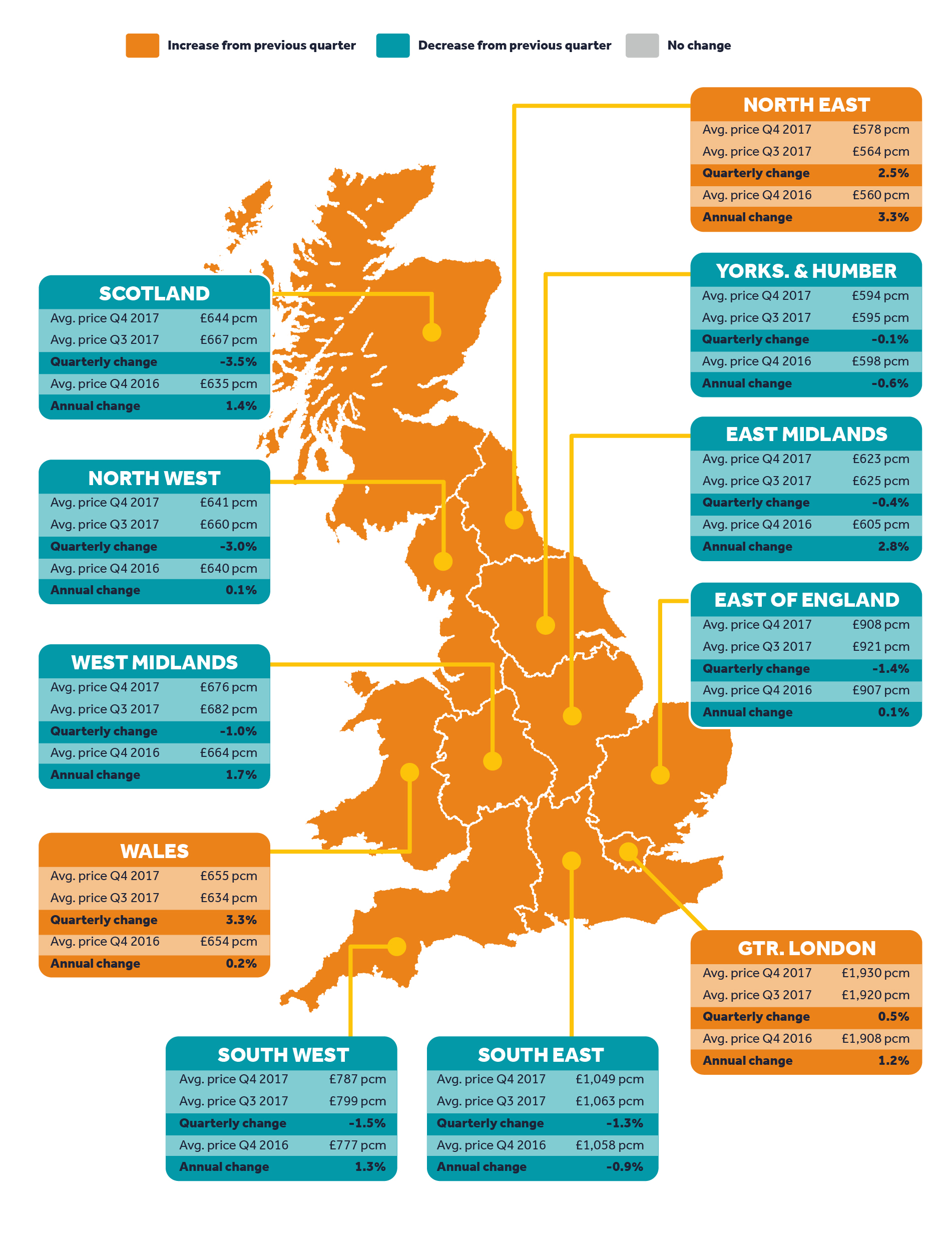

- South East and Yorkshire and the Humber are the only two regions to end 2017 with asking rents down, while the North East saw rents rising at the highest rate, up 3.3% on 2016

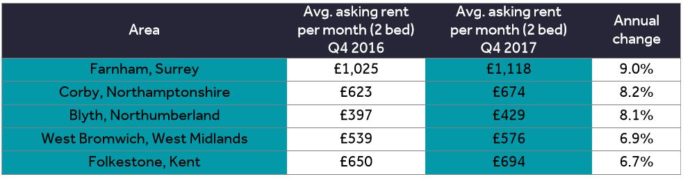

- Farnham in Surrey recorded the highest rental growth outside London at 9% in 2017, followed by Corby in Northamptonshire, up 8.2%

Overview

National average asking rents (excluding London) rose by just 0.7% in 2017, a much more muted increase than the annual rises recorded in 2015 (+3.7%) and 2016 (+3.0%). Over the last three years tenants have therefore seen landlords increase asking rents by 7.6%. With that equating to a budget-stretching average increase of over £50 per month, a slower pace of rises is understandable.

The asking rents of new rental properties coming to market in London are rising again, leading to the first increase in the annual rate of growth since the start of 2016. The uplift comes following a few years of the market readjusting downwards from the heady annual rise of 8% recorded in 2014. The falling rents were also aided by the surge in rental supply in 2016 from landlords who had rushed to buy up properties to rent out before the additional stamp duty on second homes came in. As supply has tightened prices have started to increase again.

The South East seems to be mirroring the downward trend we saw in London, with the region ending the year down 0.7% on 2016. The overall regional trend masks some of the key commuter areas that continue to perform strongly, with Farnham in Surrey coming top for rental price growth in 2017, up 9% on 2016.

Rightmove Director and housing market analyst Miles Shipside comments: “Nationally rents have been holding pretty steady over 2017, retaining the 3% plus rises seen in both 2015 and 2016, and adding a more modest 0.7% in the last twelve months. Increasingly stretched tenant affordability, and the surge of buy-to-let property supply beating the stamp duty tax hike deadline, have acted together to mute landlord pricing power. In contrast, after a few years of falling rents in London they’re back on the up again, due to a combination of tightening stock available to rent and strong demand.

“While the 2017/2018 tax year will see the start of the government’s changes to tax relief on buy-to-let mortgages, we don’t think this first phase will have that much of an effect on many landlords’ portfolio decisions until another year down the line. From speaking to some landlords they’re unlikely to make any decisions to sell up until they see in real-time how much of an impact it has on their finances, with many choosing to take a wait and see view rather than looking at short-term gains or losses. However, agents report that there are some highly-geared landlords with large loans looking to reduce their exposure to loss of tax relief by cashing in and selling some properties.”

You can see the full report here.

I Am the Agent, one of the UK's first online estate agents, has sold and let over 10,000 properties online. We offer packages starting at £49, enabling landlords to advertise properties on Rightmove, Zoopla and Prime Location. Our fees are transparent, and there are no hidden extras and no tie-ins. We can offer other landlord services, such as gas safety certificates, EPCs, credit referencing and pro photos. We don't charge tenant fees. What's not to like?

Talk to a member of the team for more information on 0333 444 1007.

Report and images courtesy of @Rightmove