Prices hit record highs in first-time and second-stepper sectors

- Average asking price of newly-marketed property jumps by 1.5% (+£4,503) this month as strong demand from home movers in the first two months of the year now feeds through to stronger upwards price pressure:

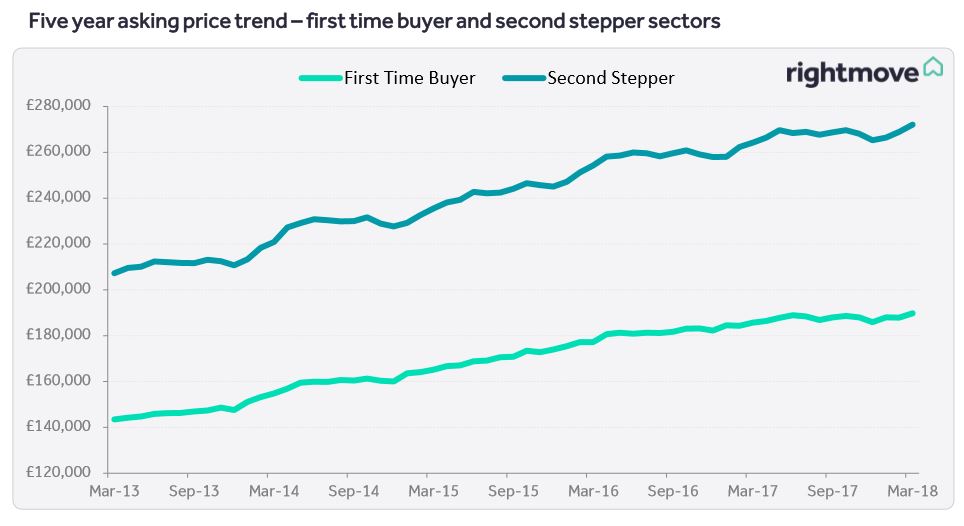

- First-time and second-stepper sectors hit all-time price highs of £189,840 and £272,031

- Overall average prices also hit new record in four out of eleven regions

- Price rise exacerbated by:

- Dip in supply with 5% fewer properties coming to market compared to the same period a year ago

- Buyers springing into action looking to benefit from possible stamp duty savings or beat forecast interest rate rise

Overview

New records in the price of property coming to market have been set in four out of eleven regions this month, and also nationally in both the first-time buyer and second-stepper sectors of the market. This month’s substantial 1.5% (+£4,503) increase seems to be a slightly delayed reaction to strong demand from home movers measured in the first two months of this year, which is now feeding through to stronger upwards price pressure. This has been exacerbated by a dip in the number of sellers coming to market, increasing the imbalance between demand and supply in some regions and market sectors.

Miles Shipside, Rightmove director and housing market analyst comments: “Many buyers entering the traditionally busy spring market this year face paying more than ever for their target property, and having a more limited choice. High demand and limited supply in parts of the country mean that the average price of newly-marketed property is at its highest ever level in four out of eleven regions. There is also upwards price pressure in the lower and middle market sectors with both first-time-buyer and second-stepper properties at new national record price highs. The first two months of 2018 saw Rightmove traffic at its highest ever levels, and this demand appears to be now feeding through to fuel the substantial £4,503 jump in average new seller asking prices this month.”

The 1.5% increase this month is the largest seen at this time of year since 2007. However, with January and February price rises having been somewhat subdued this year, there may be an element of catch-up supplementing this month’s 1.5% figure. Over the first quarter of 2018 the price of property coming to market is up by 3.0%. This is a stronger performance than the first quarter of 2017 (+1.9%) but weaker than the 3.6% rise in 2016 which was inflated by the rush to beat the stamp duty deadline on second homes.

Shipside adds: “It remains to be seen if this month’s eleven-year price rise high for March is a catch-up anomaly after two more subdued price rise months, or an early sign of price pressure building up a real head of steam as we enter the spring market. Either way, sellers need to be mindful of increasingly stretched buyer affordability, and the more they increase prices the more buyers will hit their ceiling on the amount they are able to save for a deposit and borrow for a mortgage. There does however still seem to be potential price headroom in parts of the country, especially in some of the regions in the north, and in the more mass-market sectors. However, sooner or later higher prices tend to mean fewer people can afford to move, and that is one of the factors keeping the annual rate of increase subdued at 2.1%.”

The average price of newly-marketed property has hit all-time highs in both the East and West Midlands, and also in Wales and the North West. From a property type perspective, it has also hit new record highs in the lower and middle sectors of the market nationally. First-time-buyer properties (two bedrooms or fewer) have hit an average of £189,840, 0.5% higher than their previous high seen in June 2017. Second-stepper properties, (three or four bedrooms excluding four-bedroom detached), are now coming to the market at an average price of £272,031, 0.9% dearer than their previous high recorded in October 2017. Price rises are in part being driven by a decrease in supply as the market enters a traditionally busy phase. Rightmove measured 112,693 properties coming to market in the last four weeks, down by 5.2% on the same period a year ago. Some of this drop will be due to the heavy snow delaying some agents and sellers from bringing properties to market.

Shipside observes: “As the market enters a period of seasonally higher demand, there is a heady mix of a busy time of year, pent-up demand, and shortage of suitable property supply in parts of the UK. Upwards price pressure is also being driven by savings in stamp duty for the vast majority of first-time buyers, keen to purchase before those savings are swallowed up by price rises. Ironically a sense of urgency to buy is also present from the speculation that another interest rate rise from the Bank of England is on the cards soon. Buyers who apply for a mortgage before interest rates rise should be able to borrow more cheaply.”

Estate Agent’s View

Nick Leeming, Chairman of Jackson-Stops, comments: “As we move into the spring market, which is usually the most frenetic, multiple viewings will be on the cards. Some sellers will have spotted this as an opportunity to push the limits of what a property is worth, which is likely why there has been this current uplift in average asking prices. We must view these asking prices with caution however until we are able to see how transaction rates pan out over the summer. It will be interesting to see whether deals are agreed at these higher levels, as just because sellers are asking for more money it doesn’t mean buyers will be willing to part with it.”

No spring rush to market as more would-be sellers stay put

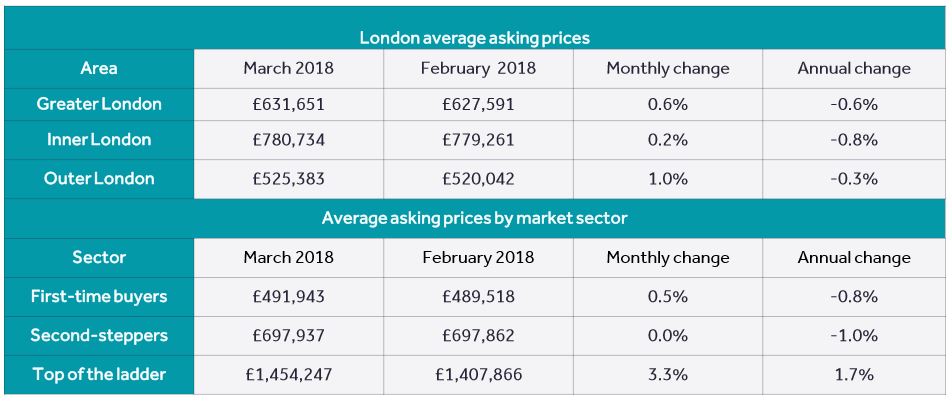

- The price of property coming to market in Greater London rises by 0.6% (+£4,060) this month

- However, annual rate continues to be in negative territory (-0.6%) for the seventh consecutive month

- Ongoing price doldrums mean no seasonal rush to market as new seller numbers down by 3% this month on the same period a year ago

- Only owners of two-bed flats are more willing to come to market (+1%) so far in 2018 compared to 2017:

- Number of five-bed houses marketed so far this year down 16% on 2017

- Four-bed houses see 6% fewer new sellers, followed by two-bed houses, down 4%

Overview

Spring is traditionally the time when many owners think of selling, and put their property on the market. However, with average new seller asking prices failing to show a year-on-year rise for the seventh consecutive month, would-be sellers seem more reticent to come to market with prices still lower than they were a year ago. The number of newly-marketed properties is down by 3% this month compared to the same period in 2017. While prices have increased by 0.6% (+£4,060) month-on-month, they remain 0.6% lower than a year ago.

Miles Shipside, Rightmove director and housing market analyst comments: “There is a lack of spring in the number of new sellers stepping onto the market. With an annual rate of price decrease as opposed to increase being a constant factor for the last seven months, it is bound to be a deterrent to some potential sellers. Even though fewer properties are coming to market, the slower rate of sales means stocks of unsold property are growing, leading to subsequent downwards price pressure. This is good news for potential buyers as it strengthens their negotiating power, but means some potential sellers are putting off their marketing given the reduced chances of selling at their desired price.”

Only owners of two-bed flats are more willing to come to market so far in 2018 compared to 2017, with an increase of 1% in their numbers. The number of one-bed flats marketed year-to-date is down by 2%, and three-bed flats by 3%. The most reticent are potential sellers of five bed houses with the number marketed so far this year down 16% on 2017. Four-bed houses are seeing 6% fewer new sellers, followed by two-bed houses with 4% fewer.

Shipside observes: “So far in 2018 owners of two-bed flats are the only ones testing the market in greater numbers than a year ago. While fewer owners of all other property types are coming to market, there is perhaps a more pressing need for space driving the desire to move on from a two-bed flat. If you live in one, extending your flat is an unlikely option to create more room for a growing family. In contrast owners of larger homes with more bedrooms are more likely to already have the space they need, so the decision to move is perhaps more discretionary. They are likely to be more able to wait for the return of rising prices before trying to sell.”

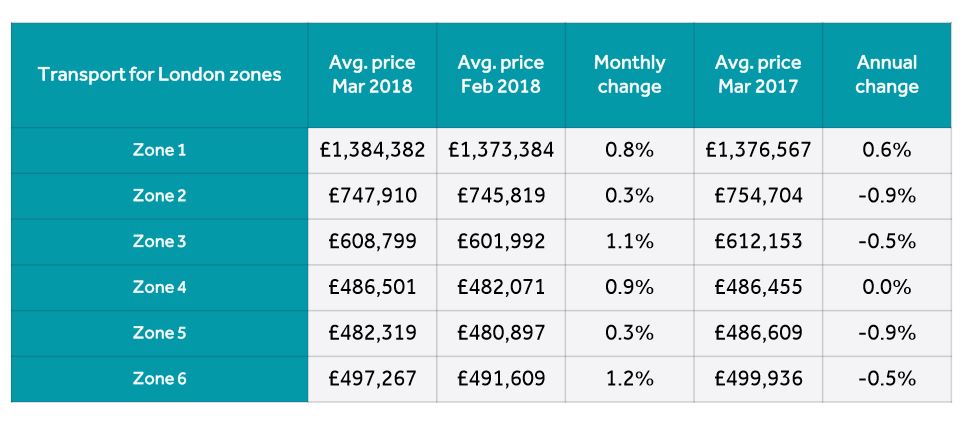

Transport for London zones

London Trends

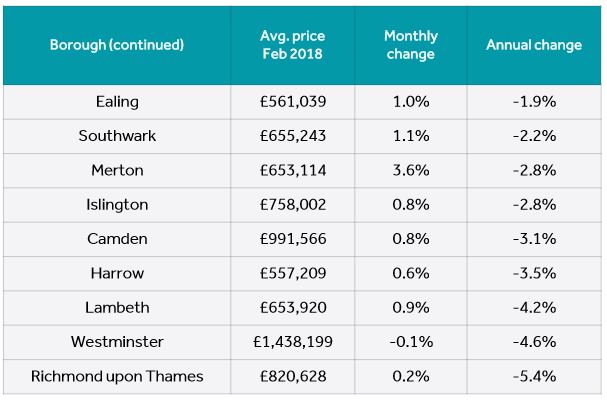

Borough data is now based on a three month rolling average and can be used as an indicator of overall price trends in each borough over time. It is not directly comparable with the overall London monthly figures.

Overview

New records in the price of property coming to market have been set in four out of eleven regions this month, and also nationally in both the first-time buyer and second-stepper sectors of the market. This month’s substantial 1.5% (+£4,503) increase seems to be a slightly delayed reaction to strong demand from home movers measured in the first two months of this year, which is now feeding through to stronger upwards price pressure. This has been exacerbated by a dip in the number of sellers coming to market, increasing the imbalance between demand and supply in some regions and market sectors.

Miles Shipside, Rightmove director and housing market analyst comments: “Many buyers entering the traditionally busy spring market this year face paying more than ever for their target property, and having a more limited choice. High demand and limited supply in parts of the country mean that the average price of newly-marketed property is at its highest ever level in four out of eleven regions. There is also upwards price pressure in the lower and middle market sectors with both first-time-buyer and second-stepper properties at new national record price highs. The first two months of 2018 saw Rightmove traffic at its highest ever levels, and this demand appears to be now feeding through to fuel the substantial £4,503 jump in average new seller asking prices this month.”

The 1.5% increase this month is the largest seen at this time of year since 2007. However, with January and February price rises having been somewhat subdued this year, there may be an element of catch-up supplementing this month’s 1.5% figure. Over the first quarter of 2018 the price of property coming to market is up by 3.0%. This is a stronger performance than the first quarter of 2017 (+1.9%) but weaker than the 3.6% rise in 2016 which was inflated by the rush to beat the stamp duty deadline on second homes.

Shipside adds: “It remains to be seen if this month’s eleven-year price rise high for March is a catch-up anomaly after two more subdued price rise months, or an early sign of price pressure building up a real head of steam as we enter the spring market. Either way, sellers need to be mindful of increasingly stretched buyer affordability, and the more they increase prices the more buyers will hit their ceiling on the amount they are able to save for a deposit and borrow for a mortgage. There does however still seem to be potential price headroom in parts of the country, especially in some of the regions in the north, and in the more mass-market sectors. However, sooner or later higher prices tend to mean fewer people can afford to move, and that is one of the factors keeping the annual rate of increase subdued at 2.1%.”

The average price of newly-marketed property has hit all-time highs in both the East and West Midlands, and also in Wales and the North West. From a property type perspective, it has also hit new record highs in the lower and middle sectors of the market nationally. First-time-buyer properties (two bedrooms or fewer) have hit an average of £189,840, 0.5% higher than their previous high seen in June 2017. Second-stepper properties, (three or four bedrooms excluding four-bedroom detached), are now coming to the market at an average price of £272,031, 0.9% dearer than their previous high recorded in October 2017. Price rises are in part being driven by a decrease in supply as the market enters a traditionally busy phase. Rightmove measured 112,693 properties coming to market in the last four weeks, down by 5.2% on the same period a year ago. Some of this drop will be due to the heavy snow delaying some agents and sellers from bringing properties to market.

Shipside observes: “As the market enters a period of seasonally higher demand, there is a heady mix of a busy time of year, pent-up demand, and shortage of suitable property supply in parts of the UK. Upwards price pressure is also being driven by savings in stamp duty for the vast majority of first-time buyers, keen to purchase before those savings are swallowed up by price rises. Ironically a sense of urgency to buy is also present from the speculation that another interest rate rise from the Bank of England is on the cards soon. Buyers who apply for a mortgage before interest rates rise should be able to borrow more cheaply.”

If you would like an up to date valuation, please don't hesitate to get in touch with our team. I Am the Agent, one of the UK's first online estate agents, has sold and let over 10,000 properties online. You can sell your property online for as little as £399 inc VAT, and that includes free pro photos or a free EPC. Talk to a member of our team on 0333 444 1007.