Buyer boom sets scene for new price records this spring

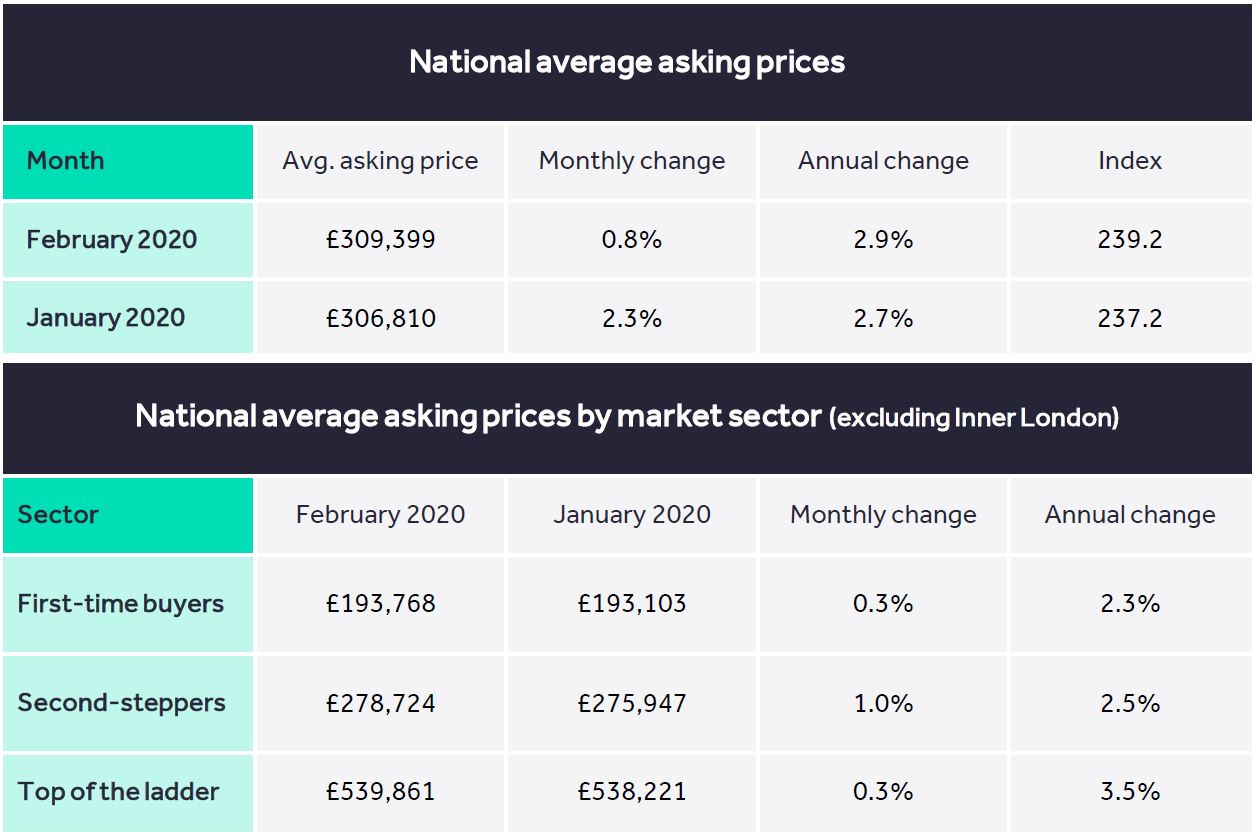

- The price of property coming to market rises by 0.8% (+£2,589) this month, just £40 short of a new all-time high as momentum builds ahead of the spring market

- Boom in buyer activity outstrips rise in number of new sellers, building upwards price pressure:

- Rightmove monthly traffic up by 7.2% on prior year to new record of over 152 million visits in January, indicating strong pent-up housing demand

- Demand already feeding through into number of sales agreed, up by 12.3% year-on-year nationally and 26.4% in London

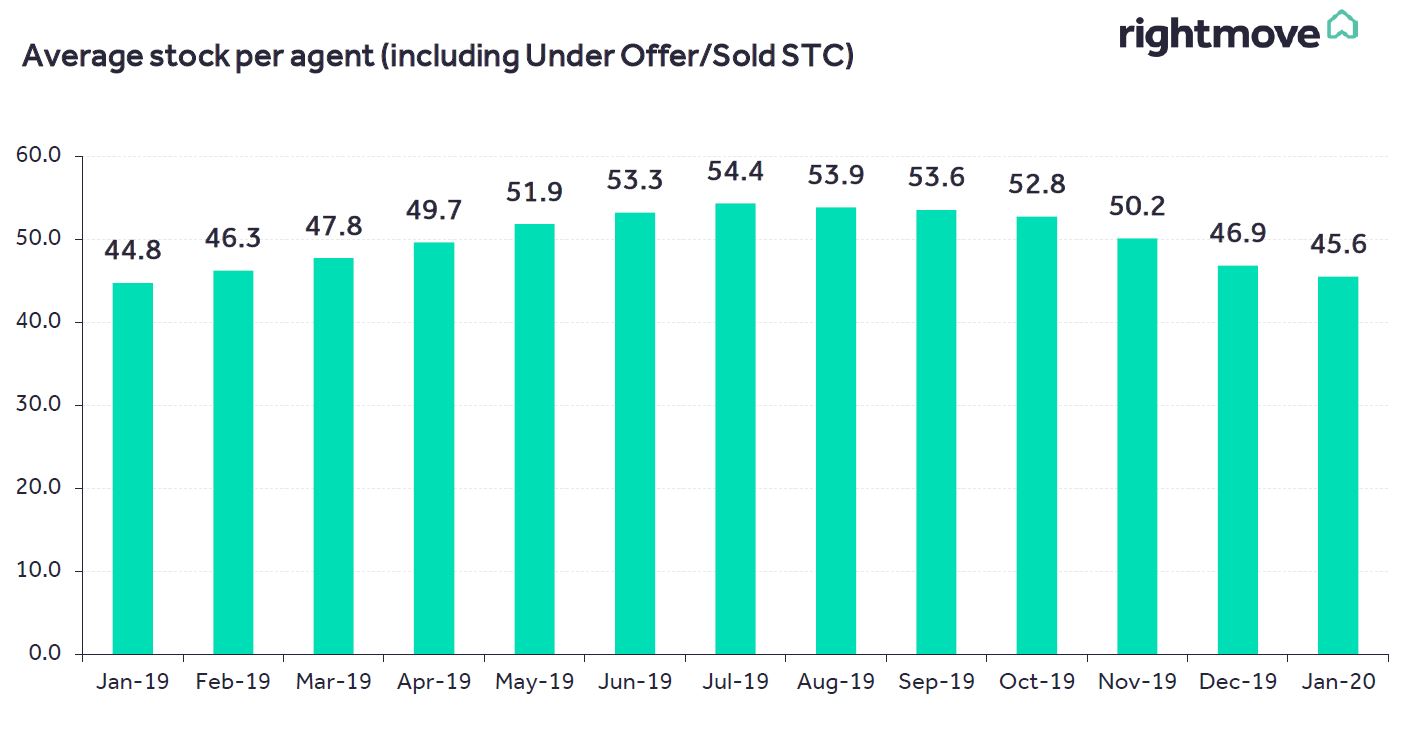

- New seller numbers fail to keep pace though finally starting to recover, up by 2.1% this month compared to the same period last year, which is the first year-on-year rise for 13 months

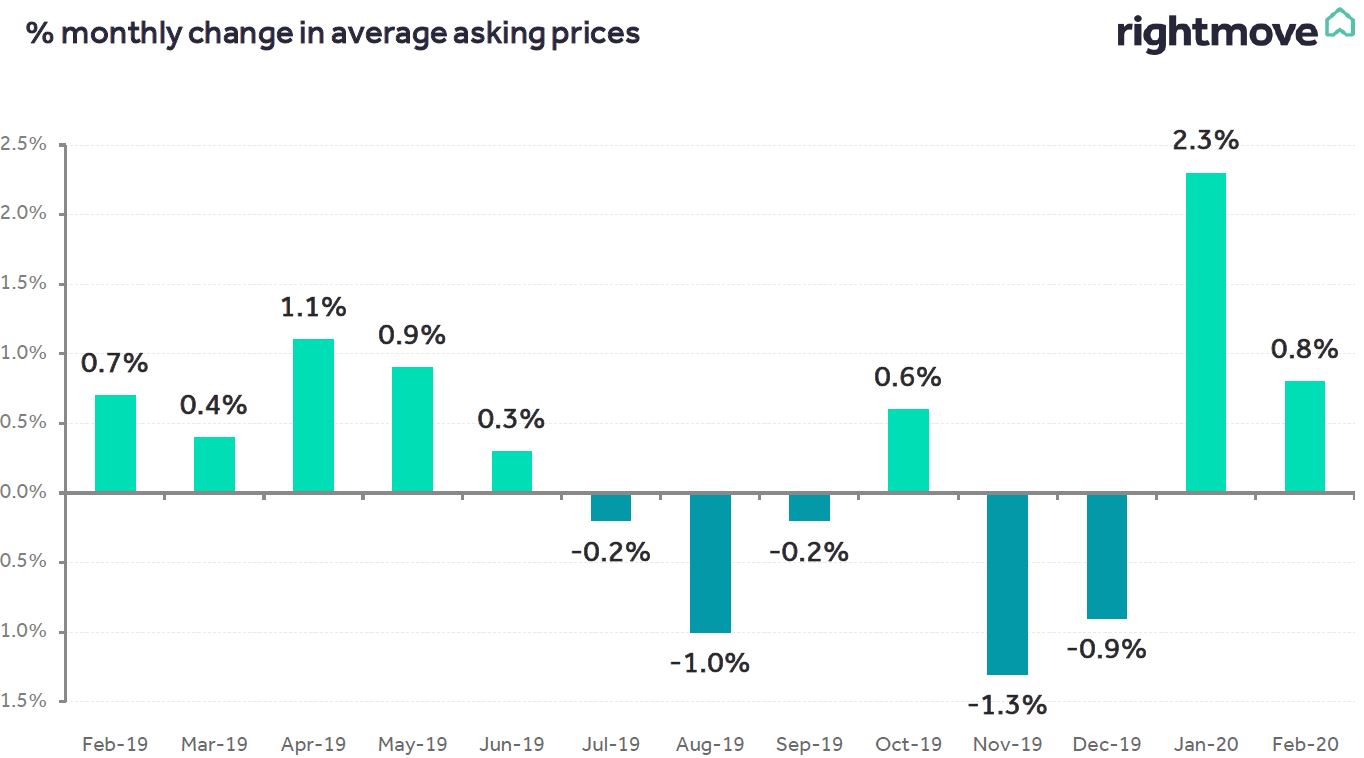

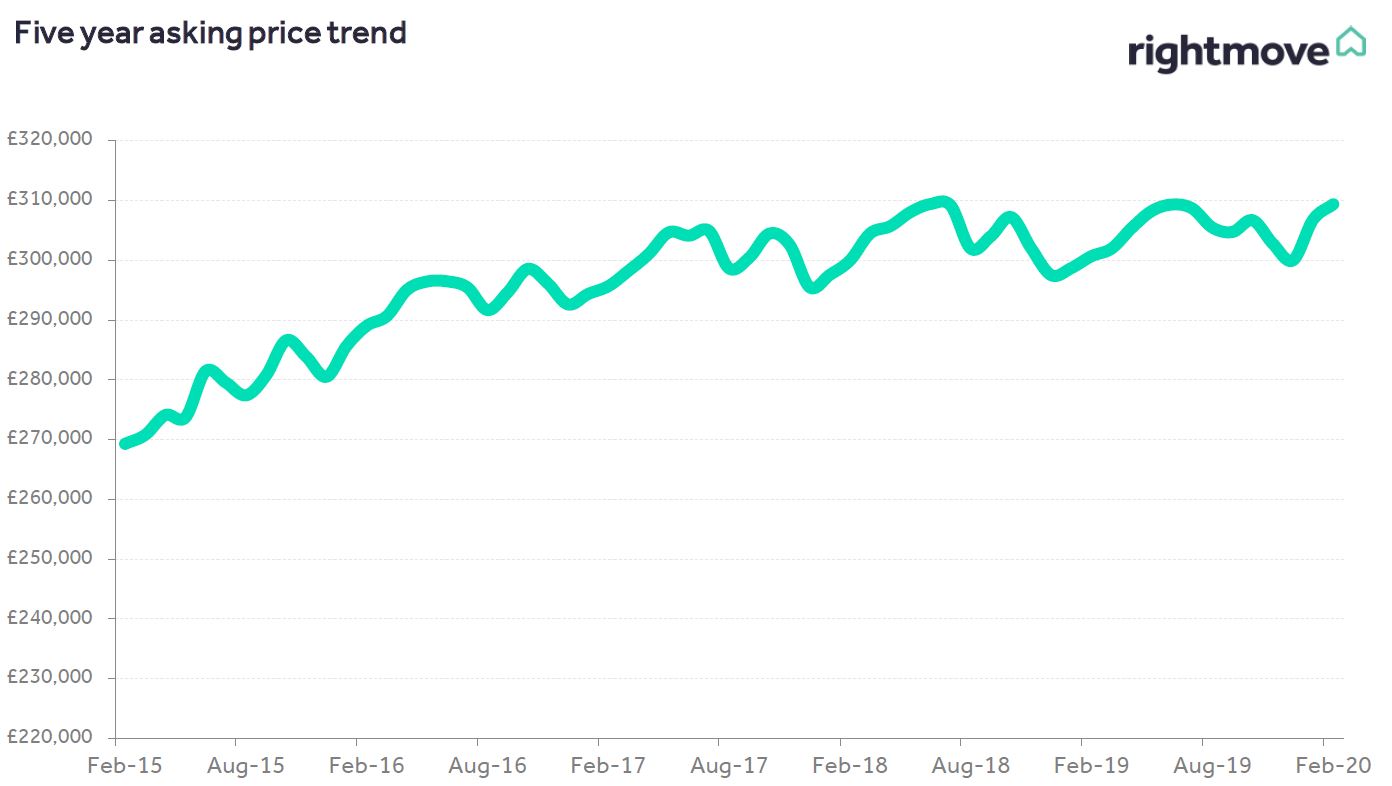

Market momentum continues to build ahead of the spring moving season, indicating that there is likely to be a series of new price records in the coming months. The average price of property coming to market rises by 0.8% (+£2,589) this month, just £40 short of a new all-time high. Upwards price pressure is being driven by a post-election release of pent-up housing demand, and while there is a long-awaited and welcome recovery in the number of new sellers coming to market, this is being out-stripped by a surge in demand from buyers.

Miles Shipside, Rightmove director and housing market analyst comments: “There is a boom in buyer activity outstripping the rise in the number of new sellers, which we expect to lead to a series of new price records starting next month. The average price of newly-marketed property is just £40 below its all-time high from June 2018, with the typically busy spring market still to come. This means that spring buyers are likely to be faced with the highest average asking prices ever seen in Britain. Buyers who had been hesitating and waiting for the greater political certainty following the election outcome may be paying a higher price, but they can now jump into the spring market with renewed confidence. After three and a half years of Brexit uncertainty, dither, and delay, many now seem to have the 2020 vision that this is the year to satisfy their pent-up housing needs.”

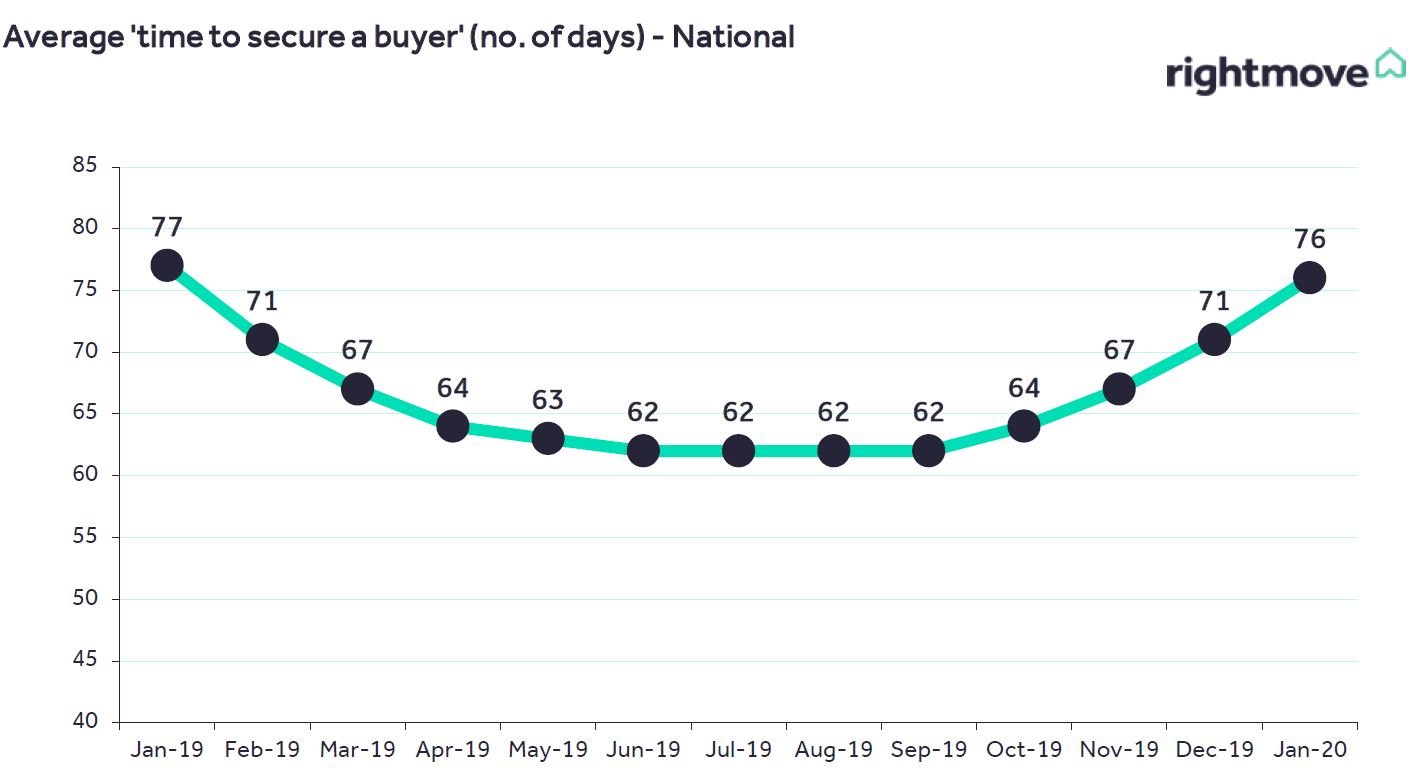

Rightmove monthly traffic is up by 7.2% on the prior year to a new record of over 152 million visits in January, indicating strong pent-up housing demand. Momentum is still growing, with traffic in the first week of February up by 9.2% on the same week in 2019. Importantly, this increased interest in property is already feeding through into the number of sales agreed, which is up by 12.3% compared to the same period a year ago. London, an important barometer of the health of the national housing market, has sales agreed numbers up by 26.4% on 12 months ago, which was admittedly a time when buyer activity was at a low ebb. Nationally, new seller numbers are failing to keep pace with the jump in sales activity, although they are finally starting to rise, with over 110,000 properties coming to market in this reporting period (12th January to 8th February inclusive), up by 2.1% compared to the same period last year. This is the first time that we have seen a year-on-year rise in new supply for 13 months.

Shipside adds: “It’s the first time for over a year that we have seen any sign of a return of seller confidence, albeit lagging behind the surge in numbers of early-bird buyers. Owners coming to market this spring face the best selling prospects for several years, with good demand for the right properties at the right prices. However, sellers should be careful not to get carried away with their pricing, as this is still a price-sensitive market with stretched buyer affordability. Those who over-price risk missing out on the window of increased activity that could run at least until we approach the next Brexit deadline at the end of the year. Now could be an excellent time to get on the market and sell, seizing the opportunity of achieving a quick sale at a decent price.”

For home-movers funding their move with a mortgage, there are some of the lowest fixed rates ever available. Many lenders have access to cheap wholesale money and the combination of this liquidity and increased competition to lend means they are offering some very tempting fixed-rate deals to help buyers to get onto or trade up on the housing ladder.

Shipside notes: “The fundamentals are sound, with lenders keen to lend at low fixed rates, real wages rising, and record high employment. The bounce in our statistics seems to show that many buyers and sellers see the election result as giving a window of stability, so if you’ve been holding back on account of Brexit, 2020 could well be your year to move.“

Agents’ views

Lucian Cook, head of Savills residential research, said: “Since the election we’ve certainly seen a significant uptick in new buyer demand in the prime market which creates a real opportunity for sellers while stock for sale remains relatively low. Increased confidence is translating into increased activity, both in the prime market and across the wider market as a whole. It is clear that the market remains largely dictated by sentiment. Our own agents are reporting that the vast majority of buyers remain unwilling to increase their budgets. Accordingly, our advice remains that sellers need to remain pragmatic on price, particularly given some of the uncertainty around an impending budget, the first of the new Government.”

Edward Heaton, founder and managing partner of Heaton & Partners, added: “It’s great to see vitality in the market once again after a year dogged by election worries and low growth. The hype of a ‘Boris Bounce’ – which was building for some time – immediately reinvigorated many of our clients purchasing plans. In an uncertain world, certainty suddenly seemed to have been restored. I would expect any house price rises we’ve seen in January to flatten by the latter part of the year, as attention will inevitably turn to ‘Deal or No Deal’. Trade negotiations will unavoidably affect market confidence – both in attracting foreign investors and housebuilders who rely on European materials.”